There are many words and acronyms that get used in relation to loans. A few are below.

APR is the annual percentage rate. It is the annual interest paid on the money that was borrowed. The

principal is the total amount of the loan, or that has been financed. A

fixed interest rate loan has an interest rate that does not change during the life of the loan. A

variable interest rate loan has an interest rate that may change during the life of the loan. The

term of the loan is how long the borrower has to pay the loan back. An

installment loan is a loan with a fixed period, and the borrower pays a fixed amount per period until the loan is paid off. The periods are almost uniformly monthly.

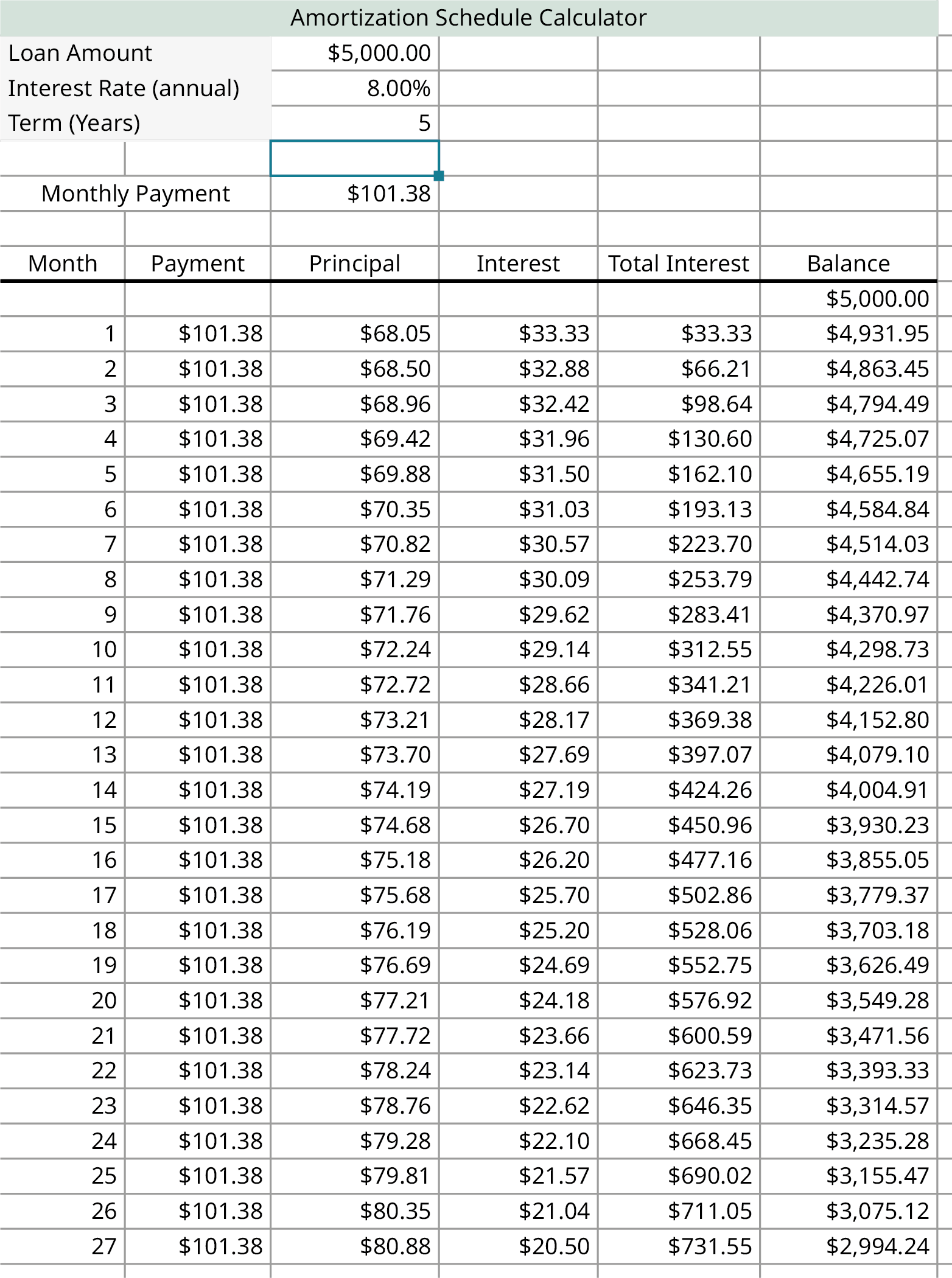

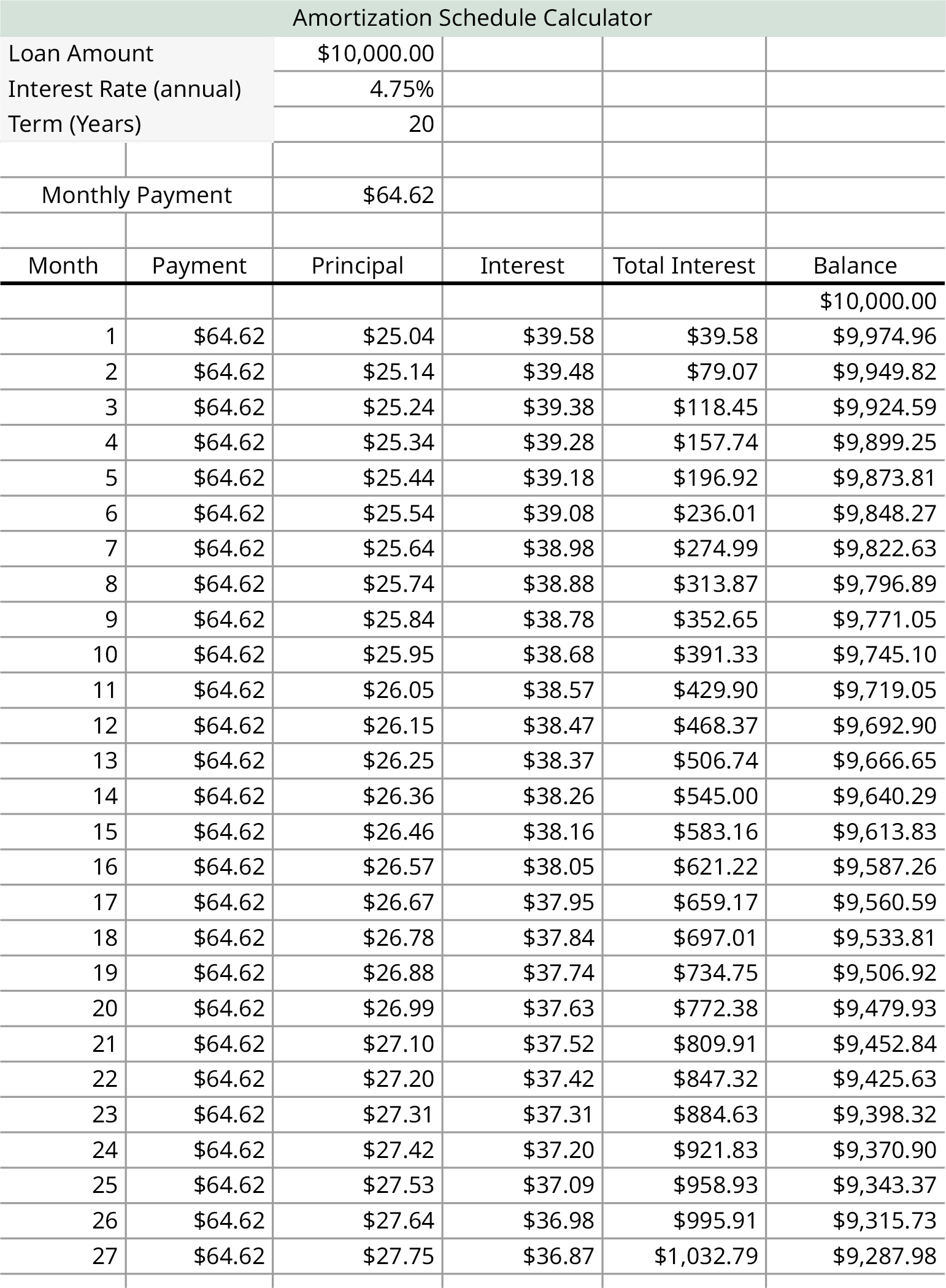

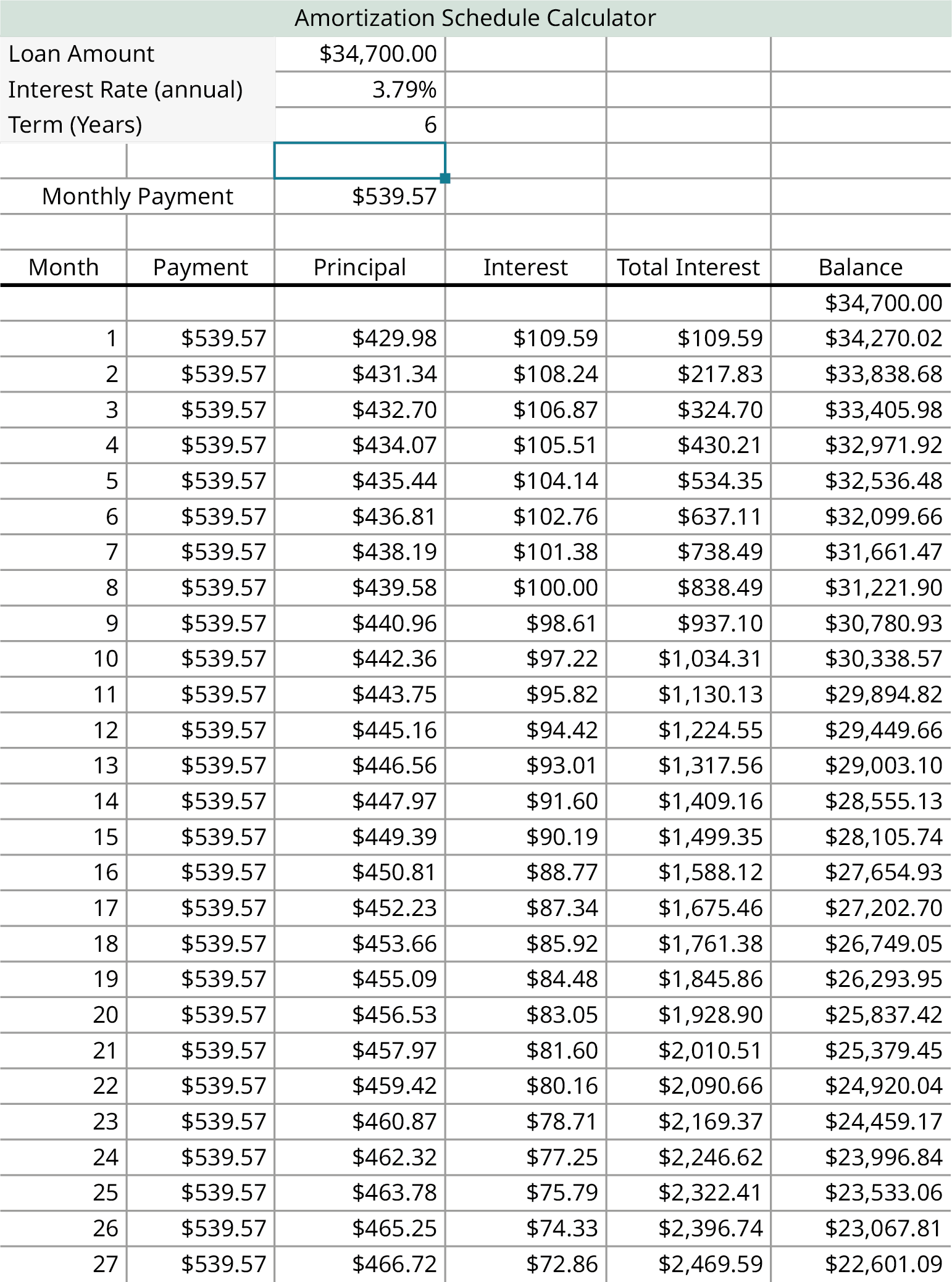

Loan amortization is the process used to calculate how much of each payment will be applied to principal and how much is applied to interest.

Revolving credit, also known as open-end credit, is how most credit cards work but is also a kind of loan account. (We learn about credit cards in

Credit Cards 4.3.) You can use up to some specified value, called the limit, any way you want, and as long as you pay the issuer of the credit according to their terms, you can keep borrowing from this account.